Published on December 8, 2024

The Psychology of Trading: Managing Emotions in the Markets

Trading in financial markets is as much a psychological challenge as it is a technical one. While charts, indicators, and strategies provide the framework for decision-making, it's the trader's emotional discipline that often determines long-term success or failure.

Understanding the psychological aspects of trading is crucial for anyone participating in the markets. Emotional responses can cloud judgment, lead to impulsive decisions, and ultimately undermine even the most sophisticated trading strategies. This article explores the common psychological challenges traders face and provides practical techniques for developing a balanced mindset.

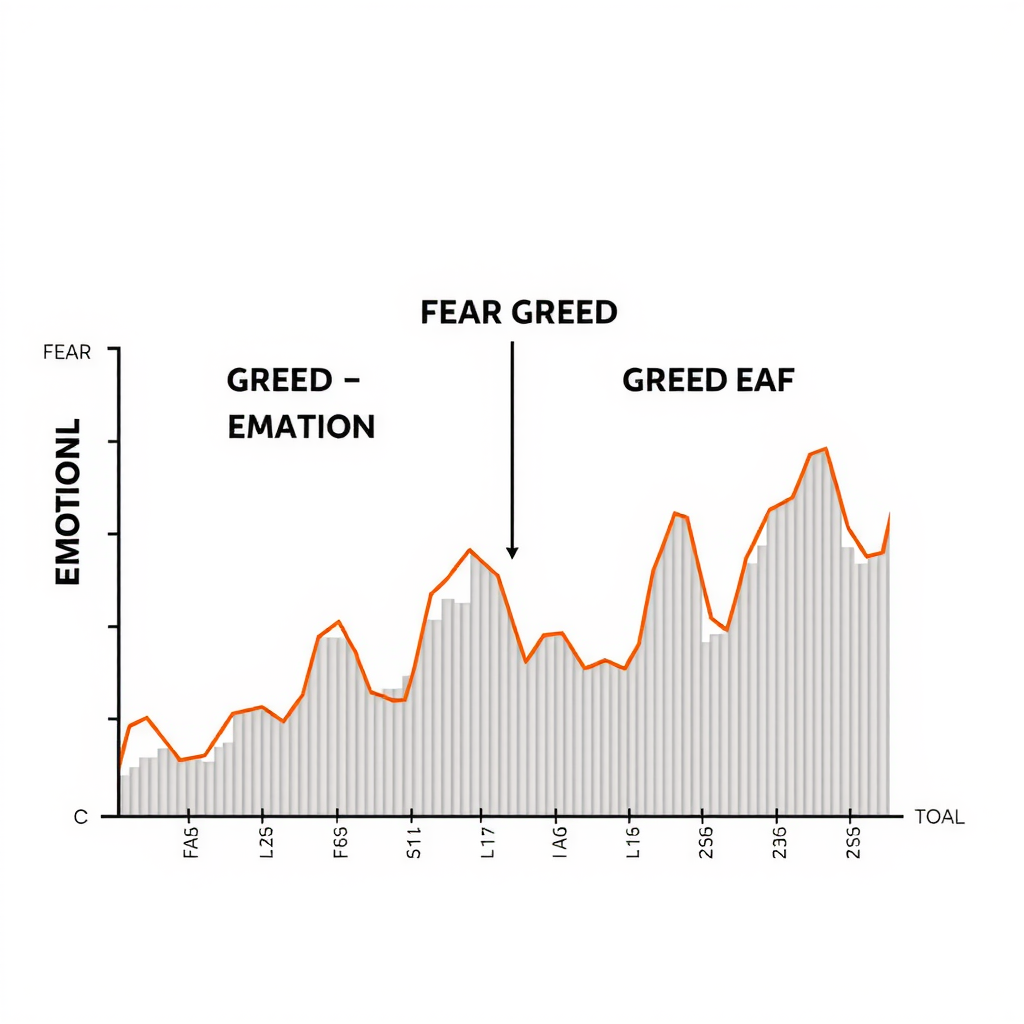

The Fear and Greed Cycle

Two primary emotions dominate trading psychology: fear and greed. These powerful forces can create a destructive cycle that traps traders in patterns of poor decision-making.

Fear in Trading

Fear manifests in several ways during market participation. The fear of missing out (FOMO) can push traders to enter positions at unfavorable prices, while the fear of loss can cause premature exits from potentially profitable trades. When markets become volatile, fear can paralyze decision-making entirely, leading to missed opportunities or holding losing positions too long.

Recognizing fear-based decisions is the first step toward managing them. Common signs include checking positions obsessively, making impulsive trades without proper analysis, or avoiding the markets entirely after experiencing losses.

Greed and Overconfidence

Greed often emerges after a series of successful trades. Traders may begin to believe they've mastered the markets, leading to increased position sizes, reduced risk management, and a false sense of invincibility. This overconfidence can quickly erode gains when market conditions change.

The desire for larger profits can also prevent traders from taking reasonable gains, holding positions too long in hopes of even greater returns. This behavior often results in watching profits evaporate as markets reverse.

Confirmation Bias and Selective Perception

Confirmation bias represents one of the most insidious psychological traps in trading. This cognitive bias causes traders to seek out information that confirms their existing beliefs while dismissing contradictory evidence.

When a trader develops a bullish or bearish view on a particular asset, confirmation bias can lead them to interpret all market data through that lens. Positive news is amplified while negative indicators are rationalized away or ignored entirely. This selective perception prevents objective analysis and can result in holding onto losing positions far longer than prudent.

Combating Confirmation Bias

- Actively seek out opposing viewpoints and alternative analyses

- Maintain a trading journal documenting both supporting and contradicting evidence

- Establish clear entry and exit criteria before entering positions

- Use stop-loss orders to enforce discipline regardless of personal beliefs

- Regularly review past trades to identify patterns of biased thinking

The Impact of Loss Aversion

Research in behavioral economics has demonstrated that people feel the pain of losses approximately twice as intensely as they feel the pleasure of equivalent gains. This phenomenon, known as loss aversion, significantly impacts trading behavior.

Loss aversion can cause traders to hold losing positions too long, hoping they'll recover, while simultaneously taking profits too quickly on winning trades. This creates an unfavorable risk-reward dynamic where losses accumulate while gains remain modest.

Understanding loss aversion helps traders recognize when emotions are driving decisions rather than rational analysis. By acknowledging this natural tendency, traders can implement systems and rules that counteract its influence.

Developing Emotional Discipline

Building emotional discipline requires consistent practice and self-awareness. The following techniques can help traders develop a more balanced psychological approach to market participation:

Create a Comprehensive Trading Plan

A well-defined trading plan serves as an emotional anchor during periods of market stress. This plan should outline specific entry and exit criteria, position sizing rules, risk management parameters, and guidelines for various market conditions. When emotions run high, referring back to the plan provides objective guidance.

The plan should be developed during calm periods when rational thinking prevails, not in the heat of market action. It should be detailed enough to guide decisions but flexible enough to adapt to changing market conditions.

Maintain a Trading Journal

Documenting trades, including the reasoning behind decisions and emotional state at the time, provides invaluable insights into psychological patterns. Regular review of this journal helps identify recurring emotional triggers and behavioral patterns that may be undermining performance.

The journal should capture not just what happened, but how you felt before, during, and after each trade. Over time, patterns emerge that reveal personal psychological tendencies and areas requiring improvement.

Practice Mindfulness and Stress Management

Incorporating mindfulness practices can significantly improve emotional regulation during trading. Techniques such as meditation, deep breathing exercises, and regular breaks help maintain mental clarity and reduce stress-induced decision-making.

Physical exercise, adequate sleep, and proper nutrition also play crucial roles in maintaining the mental stamina required for disciplined trading. The mind and body are interconnected, and neglecting physical health inevitably impacts psychological performance.

Taking regular breaks from market monitoring prevents emotional exhaustion and helps maintain perspective. Stepping away from screens allows for clearer thinking and reduces the tendency toward impulsive reactions.

Implement Position Sizing and Risk Management

Proper position sizing removes much of the emotional intensity from individual trades. When no single trade can significantly impact overall capital, the psychological pressure decreases substantially. This allows for more objective decision-making and reduces the fear associated with potential losses.

Risk management rules should be established before entering any position and strictly adhered to regardless of emotional impulses. Using stop-loss orders and predetermined exit points removes the need for emotional decision-making during volatile market conditions.

The Role of Patience and Discipline

Patience represents one of the most valuable yet challenging psychological attributes for traders to develop. Markets don't always present ideal opportunities, and forcing trades out of boredom or impatience often leads to poor results.

Disciplined traders understand that waiting for high-probability setups is part of the process. They resist the urge to be constantly active in markets, recognizing that sometimes the best action is no action at all. This patience extends to allowing winning trades to develop fully rather than taking premature profits.

Developing patience requires shifting perspective from short-term excitement to long-term consistency. It means accepting that trading success is measured over months and years, not days or weeks.

Learning from Losses

How traders respond to losses reveals much about their psychological maturity. Losses are inevitable in trading, but they can serve as valuable learning experiences when approached with the right mindset.

Rather than viewing losses as personal failures, successful traders analyze them objectively to identify what went wrong. Was the loss due to a flaw in the strategy, poor execution, or simply normal market variance? This analytical approach removes the emotional sting and transforms losses into educational opportunities.

Constructive Loss Analysis

After experiencing a loss, take time to conduct a thorough review:

- Did you follow your trading plan, or was the decision emotionally driven?

- Were your entry and exit criteria clearly defined and executed properly?

- Was position sizing appropriate for your risk tolerance?

- What market conditions or factors did you overlook or misinterpret?

- What specific lessons can be extracted to improve future decision-making?

Accepting that losses are part of trading removes the emotional burden of perfectionism. No trader wins every trade, and attempting to do so creates unrealistic expectations that lead to psychological stress and poor decision-making.

Building Long-Term Psychological Resilience

Developing psychological resilience in trading is an ongoing process that requires commitment and self-reflection. It involves building mental frameworks that support rational decision-making even during periods of market stress or personal uncertainty.

Resilient traders maintain perspective by focusing on process rather than outcomes. They understand that following a sound methodology consistently will produce positive results over time, even if individual trades don't always work out as planned.

This long-term perspective helps buffer against the emotional highs and lows that come with short-term market fluctuations. By measuring success through adherence to their trading plan rather than daily profit and loss, traders reduce psychological pressure and improve decision quality.

Conclusion

The psychology of trading represents a critical yet often underestimated component of market success. While technical analysis and strategy development receive considerable attention, emotional discipline ultimately determines whether traders can execute their plans effectively.

Understanding common psychological challenges such as fear and greed cycles, confirmation bias, and loss aversion provides the foundation for developing better emotional management. Through consistent application of techniques like maintaining a trading journal, practicing mindfulness, implementing proper risk management, and cultivating patience, traders can build the psychological resilience necessary for long-term success.

The journey toward emotional mastery in trading is ongoing and requires honest self-assessment and continuous improvement. By recognizing that psychology plays as important a role as technical skill, traders position themselves to navigate markets with greater clarity, discipline, and ultimately, better results.

Remember that developing psychological discipline is not about eliminating emotions entirely—that's neither possible nor desirable. Instead, it's about recognizing emotional responses, understanding their impact on decision-making, and implementing systems that prevent emotions from undermining rational analysis. With time and practice, this balanced approach becomes second nature, allowing traders to participate in markets with confidence and composure.